Healthcare Business Insurance in Oakland, San Francisco, Santa Clara and Nearby Cities

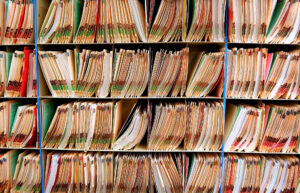

Navigating the Complexities of Healthcare Business Insurance through these As a healthcare provider, ensuring the protection of your business through comprehensive insurance coverage is paramount.